25.05.2022

The number of customers opening an account using open banking is growing

Already more than half of new customers of Bank Millennium, when opening an online account, confirm their identity by logging in to the online banking of another bank. The bank continues to expand its open banking services, adding more banks to them. Now as part of the services: opening an account by individual customers with confirmation of identity by logging in to another bank, opening a business account for sole traders as well as instalment loans in partner stores with logging in to the bank account, the bank provides two new ones - Credit Agricole and Getin Bank.

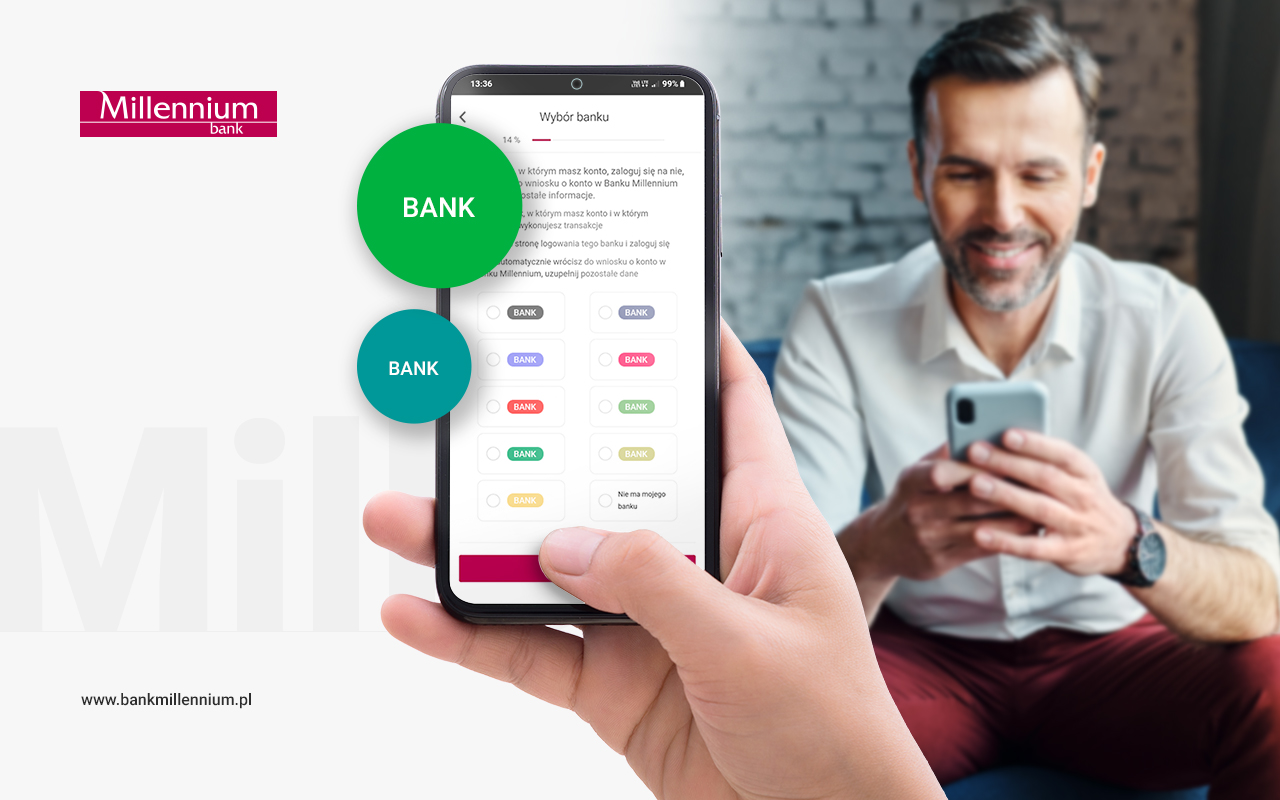

Opening a personal account using an identity verification service by logging in to another bank is a process entirely online, allowing you to open an account and start using it within 15 minutes. Bank Millennium was the first on the market to implement the account opening process, using the potential of the Account Information Service (AIS). To set up an account in this way, you must select the Online option on the electronic application as a form of signing the contract and indicate another bank in which you have an account on the list. Then all you have to do is enter the basic data and log in to the account at the previously indicated bank to check your identity. After reviewing the documents and expressing the relevant consents, we will approve the contract with an SMS password. Currently, the service can be used by people with a personal account at Alior Bank, Bank Pekao, BNP Paribas, ING Bank Śląski, mBank, Santander, PKO BP, and now also Credit Agricole and Getin Bank.

Also, sole traders who do not yet have an account at Bank Millennium can set up a My Business account fully online, confirming their identity by logging in to another bank where they have their individual account. To open a company account, go to the Bank Millennium website and fill out an electronic application. After selecting the online option and entering basic data, the customer in order to authenticate the identity is directed to the login page of one of nine banks: Alior Bank, Bank Pekao, BNP Paribas, ING Bank Śląski, mBank, Santander, PKO BP, as well as Credit Agricole and Getin Bank. After positive verification the bank will ask for some data. After the NIP number has been provided the remaining business data will be drawn automatically from the CEIDG register. You can also order a debit card outright. Then you need to confirm the instructions to open the account with the SMS code, which will be sent to the phone number you will have provided in the application form.

Another service now also available to customers of Credit Agricole and Getin Bank is an application for an instalment loan from Bank Millennium partners. The process uses open banking and is fully proprietary. It is automatic and adapted to any type of device, and the data to be provided have been reduced to the necessary minimum. Customers who want to pay in instalments for purchases in the online stores of the bank's partners, when submitting the application, can confirm their identity by logging in to one from 10 banks - Bank Millennium, Alior Bank, Bank Pekao, BNP Paribas, ING Bank Śląski, mBank, Santander, PKO BP, Credit Agricole and Getin Bank. The application is processed in real time, customers immediately finalise the loan. In the case of one of the banks, the so-called verification transfer has been used – in such a situation, the loan is granted no later than on the next business day.

Bank Millennium is the leader in open banking services in Poland. The offered solutions have been appreciated in international competitions: The Innovators 2021 by The Global Finance magazine and Celent Model Bank 2021.