03.07.2024

Exchange currencies in the Bank Millennium app

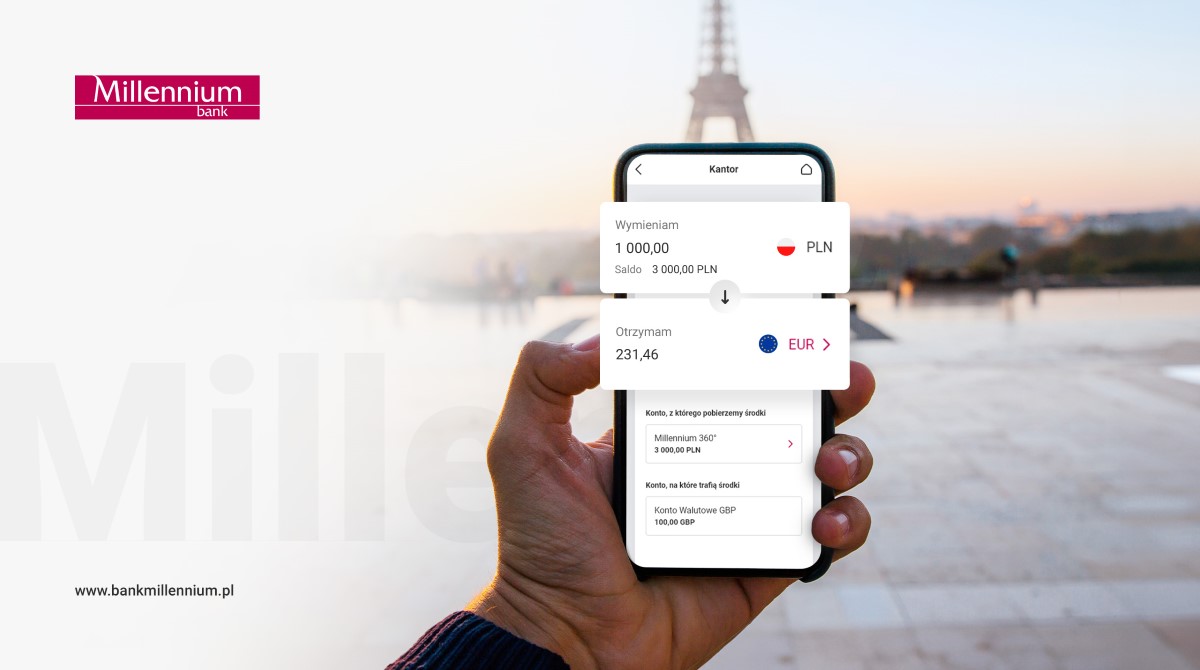

Bank Millennium has launched the currency exchange functionality in its mobile application. This is a significant convenience feature for customers who are planning holiday trips abroad.

From 1 July, the first Bank Millennium customers can now instantly exchange currencies in the Bank Millennium mobile application. The exchange service allows you to immediately buy or sell currencies within your accounts. It is available 24 hours a day, 7 days a week for adult retail clients and micro-enterprises. It meets the high security standards of banking services and will come handy during foreign holidays. In the exchange office, you can exchange currencies: euros (EUR), dollars (USD), British pounds (GBP) and Swiss francs (CHF). The Bank makes the service available gradually – customers will be informed in the Bank's channels when they receive access to it.

- An exchange office is a hassle-free and fast way to manage currency exchange. At our fingertips, we can buy local currency simply, reliably and securely. In the mobile app of Bank Millennium we invariably offer attractive currency conversion rates, without an additional margin. We hope that customers will appreciate this method of exchange and we are glad that we managed to complete all the technical details of the service for this hot holiday travel period - says Ernest Lachowski, Head of the Mobile and Internet Development Sub-unit at Bank Millennium.

- A simple and intuitive exchange office that allows customers to exchange currency online 24 hours a day, 7 days a week is in fact a complex ecosystem of numerous internal and external IT solutions. The success of the implementation was driven by the work of a number of technological units in the Bank. The process was built on the basis of our Mobile Platform. It offers a consistent experience on Android, iOS and HarmonyOS smartphones. In the background, we used cloud solutions to ensure always up-to-date prices and a system that allows us to hedge the Bank's currency positions regardless of the time of day and week. The exchange platform itself operates on a proven microservice architecture ensuring scalability adapted to user traffic and the possibility of expanding with new functionalities in the future. – says Franciszek Biały, Head of the Online Solutions Design Team at Bank Millennium.

Customers will find the exchange office in the Bank's application in the additional services section. On the first transaction, they will be asked to accept the terms and conditions. If they do not have an account in the currency they want to exchange their funds to, they will be able to open one right away. Transactions in the exchange office are carried out as part of your own transfer, so the funds appear immediately on the appropriate account. In addition, the customer can check historical rates in the application and set notifications when a given price level is reached on the market.

- The Bank also allows you to link foreign currency accounts (EUR, USD, GBP and CHF) to any debit card. This opens up the possibility of paying in currency with the money accumulated on these accounts. Only if there are no funds on the linked foreign currency account, the transaction will be settled from the account in PLN. – says Szymon Kuchciak, Head of the Payment Cards Sub-unit at Bank Millennium.

From 1 July, the Bank also introduced other changes to the offer, some important for those travelling abroad. The currency limit was raised to as much as PLN 5,000 per month. The solution is intended for customers paying in foreign currency directly from the Millennium 360° account or by credit card. The limit allows you to settle currency transactions with a card without the Bank's margin for currency conversion. The Bank also invariably uses attractive exchange rates of payment organizations for transactions in currency made with all types of cards.

More information at www.bankmillennium.pl.