Since 25.08 It will not be possible to log in to Millenet from the version of the browser you are now using. Update the browser on your device and use online banking in a comfortable and secure way.

Update the browserFinancial education started already at kindergarten age makes coping with later crisis situations easier - so say most parents taking part in a survey carried out by GfK for Bank Millennium Foundation. The full survey report will be published by Bank Millennium Foundation this September.

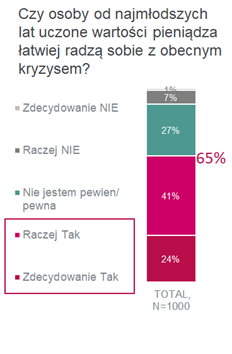

In answer to the question “Do people taught from their youngest years about the value of money find it easier to cope with the current crisis?” close to 2/3 of respondents – parents of children aged 3-7 – said “yes”. - Good habits developed in less stressful times bear fruit when the times get tougher. Most parents of children of kindergarten age are of the opinion that people taught from their youngest years about the value of money find it easier to cope with the current crisis involved with the coronavirus epidemic - Iwona Jarzębska, Chairman of the Bank Millennium Foundation, said.

Among parents who have various banking products (significantly more often among those who have bank deposits and invest in funds and stocks) a greater conviction is to be seen that in the current times of crisis people taught from their youngest years about the value of money are financially resourceful.

– We want to support parents in financial education of children. We believe that knowledge is the best insurance for the future. For years now we have been carrying out the “Financial ABCs” training in kindergartens and soon we will be launching a series of guidance articles prepared specially with a view to parents of kindergarten kids – Iwona Jarzębska added.

- We live in times of a knowledge-based society. Implementing an advanced educational system, which skilfully combines two main sets of competencies of the modern man, i.e. general classical education with the competencies and skills needed to efficiently more around in the contemporary technical environment, is one of the main solutions leading to reduction (or prevention) of the civilisational gap with respect to developed countries worldwide. A citizen’s relationships with the sphere of money, the financial system, personal finances i.e. manifestations of conscious consumer attitudes, which may be developed from the youngest years, are one of the components of such a set of competencies. However awareness of both sides of the process is needed - of the parents and educators alike, counsellors, tutors, teachers. The educational work of Bank Millennium Foundation, as well as the survey results, show that as a society we are ready for it however we are still at the beginning of the road - Rafał Neska, Strategic Insight Manager, expert in GfK, commented.

Full survey results will be published this September. The survey was carried out by GfK institute for Bank Millennium Foundation in May 2020 on a national sample of 1000 parents of children aged 3–7, using the CAWI method.