26.10.2021

Good operational results and cost effectiveness improvement. Financial results under the burden of provisions against FX loans

Consolidated results of the Bank Millennium Capital Group after 3 quarters of 2021.

Consolidated net result of the Bank Millennium Group after 3 quarters 2021 amounted to -823 mln PLN (-311 mln PLN in Q3). The loss results from creation of provisions against legal risk connected with FX mortgage loan portfolio in the amount of 1 573 mln PLN (526 mln PLN in Q3) and costs of individual negotiations with CHF borrowers – 218 mln PLN (146 mln PLN in Q3). After adjustment for the above costs, the result would be 791 mln PLN net (269 mln PLN in Q3 only). Sale of new mortgage loans reached 6.9 bn PLN (+50% y/y), cash loans 4.2 bn PLN (+20% y/y), thus breaking another record in retail lending activity.

- Results of the 9M21 show that the Group has successfully weathered the direct and indirect impacts of the pandemic. Excluding provisions and costs related to FX-mortgages, the Group would post 9M21 net profit of PLN791 million and in 3Q21 of PLN269 million. Core revenues grew, the costs efficiency level was maintained at high level as well as Bank moved forward in digitalisation process and offering new functionalities to customers. Bank continues to be open to its customers in order to reach amicable solutions regarding FX-mortgages on negotiated terms. As a result the number of active FX-mortgage loans decreased by almost 6,600 in period January-September 2021. It is worth to stress that in the recent months, the monthly and quarterly reduction of the number of FX-mortgage loans has been higher than the inflow of new individual court cases against the Bank. We are now focusing on finalisation of the 2022-2024 strategy, which will define future directions of the Group development – said Joao Bras Jorge, Chairman of the Management Board of Bank Millennium.

Main financial and business achievements of the group

3Q21 results were another proof that the BM Group successfully mitigated most of the direct and indirect impacts of the pandemic. 3Q21 adjusted pre-provision profit (ex-costs of amicable conversions, legal costs, result on FV portfolio and netting-off EB's FX-mortgage provisions) amounted to PLN528 million and was 8% above the result in 3Q20 (9M21: PLN1,525 million, +12% y/y). The improvement was driven by positive operating jaws. 9M21 revenues were up 1% y/y (1H21: 0% y/y) with y/y dynamic of NII nearing 0% (1H21:-4% y/y) and y/y fee growth remaining strong at 11% y/y while opex (ex-BFG and legal costs) was down 9% y/y (1H21: -12% y/y).

The accelerating growth in core income (3Q21: +8% y/y vs. 5% in 2Q21 and -6% in 1Q21) was the main element stabilising revenues, while non-core income dropped in 9M21 (and in 3Q21) due to lower profits on bonds and revaluations among others. Opex reduction stemmed from savings in staff costs (9M21: -7% y/y, 1H21: -9% y/y) but most of all non-staff costs ex-D&A(9M21:-14% y/y, 1H21: -19%). BFG charges which in 9M21 were 28% lower than in the same period last year provided an additional support.

The key developments in the last twelve months that drove the y/y improvement of the results and which, we believe, are particularly worth highlighting are as follows:

- continued recovery of NII with 3Q21 up 6% y/y to 94% of the record high NII of 4Q19;

- continued (albeit decelerating) improvement of quarterly NIM (261bps in 3Q21, just 38bps below the 3Q19 peak of 299bps and 12bps up from the low of 249bps in 3Q20);

- above-market loan growth (+6% y/y) despite accelerating reduction of the FX-mortgage portfolio; solid retail loan originations played a key role - disbursements of mortgages in 3Q21 reached PLN2.2bn, up 29% y/y (9M21: PLN6.9bn, up 50% y/y) translating into market share of 10.4% vs. 14.5% in 3Q20 while 3Q21 origination of cash loans reached a new record of nearly PLN1.6bn, up 30% y/y (9M21: PLN4.2bn, up 20% y/y); on a separate count our gross FX-mortgage book contracted 26% y/y due to a combination of repayments, provisioning (in line with IFRS9 most of legal risk provisions are booked against gross value of loans under court proceedings) and amicable conversions; as a result, the share of FX-mortgages in total gross loans decreased to 13.6% (BM originated only: 12.6%) from 19.6% (18.3%) in the same period last year;

- improving cost efficiency owing to a combination of a steady increase in the digitalisation of our business and well as relations with clients with strong cost response to revenue pressures; falling headcount (number of active employees down 648 or 9% since 3Q20), ongoing optimisation of our physical distribution network (own branches down by 59 units or 12% in the last twelve months) complimented the increasing share of digital services (digital customers: 2.2 million, up 9% y/y, number of active mobile customers: 1.9 million, up 15% y/y); cost optimisation initiatives not only resulted nominal reduction of opex but also translated into much improved cost efficiency; reported C/I ratio ticked up to 45.9% in 3Q21 from 46.4% in the same period last year but C/I ratio excluding BFG, FV portfolio, costs of amicable conversions offered to FX-mortgage borrowers and netting-off of FX-mortgage provisions on f.EB book eased y/y to 41%;

- stable loan book quality resulting in a low cost of risk (42bps in 3Q21 vs. 80bps in 3Q20, 9M21: 36bps vs. 9M20: 92bp) with positive underlying trends in quality of both retail and corporate books and continued NPL disposals (in 3Q21 spefically no such transaction took place though); NPL ratio ticked down to below 4.7% at the end of September 2021 from over 4.7% the year before;

- customer deposits were stable in the quarter (and up 5% y/y) with corporate ones up 1% q/q and retail ones flat; the liquidity of the Bank remained very comfortable with L/D ratio at 85.6%;

- capital ratios fell somewhat in the quarter (Group TCR: 18.2%/T1: 15.1% vs. 18.7%/15.6% respectively at the end June’21) as the drop of equity outweighted the drop of RWAs;

- AuM of Millennium TFI and third party funds combined grew 1% q/q to over PLN9.5 billion with y/y growth at 21%.

Share in key market segments

Strategy implementation

Given the unprecedented scale of change of the business environment caused by the outbreak of COVID-19 pandemic in early 2020 the BM Group decided to extend its 2018-20 strategy by additional year and prepare a new one for the years 2022-2024 with publication date planned for late 4Q21.

The Bank aims to recover like-for-like operational results affected by the COVID-19 crisis and its direct and indirect consequences within 1.5 to 2 years. This is to be achieved by completion of the current cost streamlining program, introduction of new operational efficiency program as well as an improvement business results through improved pricing and sales increase in core products. The improvement will be further supported by the recent increase in interest rates.

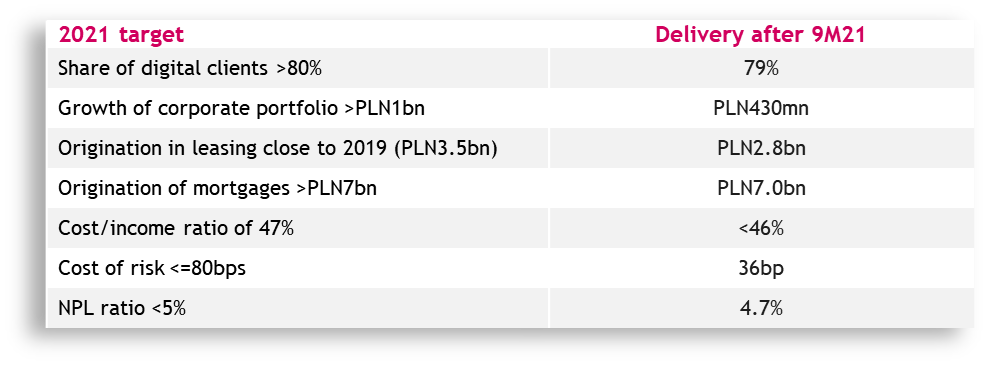

The Group is on well on track to deliver on its 2021 targets:

Results of the Group are also available here: www.bankmillennium.pl/en/about-the-bank/investor-relations