Od 25.08 nie będzie możliwe logowanie do Millenetu z wersji przeglądarki, z której teraz korzystasz. Zaktualizuj przeglądarkę na swoim urządzeniu i korzystaj z bankowości internetowej wygodnie i bezpiecznie.

Zaktualizuj przeglądarkęPoznaj trzy gotowe Plany

Inwestowanie społecznie odpowiedzialne

Plan Aktywny, Plan Wyważony i Plan Spokojny są oparte na kryteriach zrównoważonego rozwoju ESG. Oznacza to, że w ich portfelach znajdziesz spółki, które stawiają na wzrost w tym duchu.

Inwestując w te fundusze, wspierasz:

- aspekty środowiskowe

- aspekty społeczne

- kwestie przestrzegania ładu korporacyjnego

Jak zacząć inwestować?

Plan Inwestycyjny Millennium możesz wygodnie założyć w Millenecie i aplikacji mobilnej lub w placówce Banku.

-

1

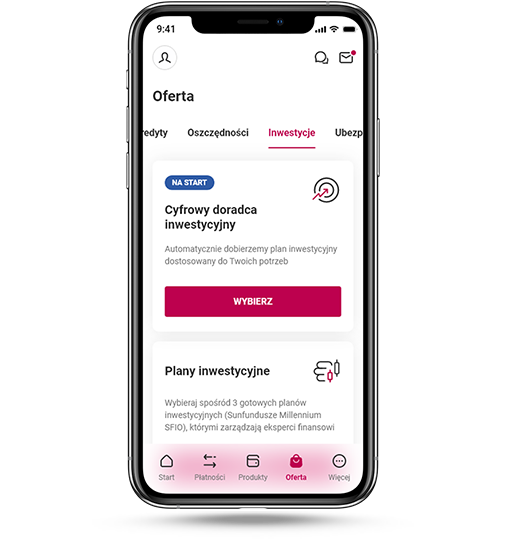

Aby założyć plan online, w menu w aplikacji wybierz Oferta > Inwestycje > Plany inwestycyjne

-

2

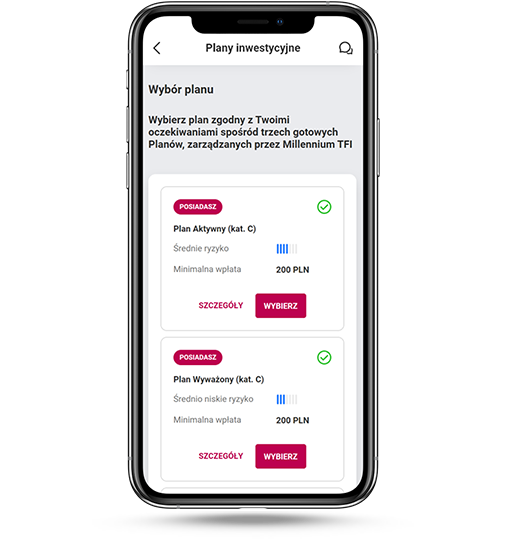

Zapoznaj się ze szczegółami Planów, aby wybrać najlepszy dla siebie.

-

3

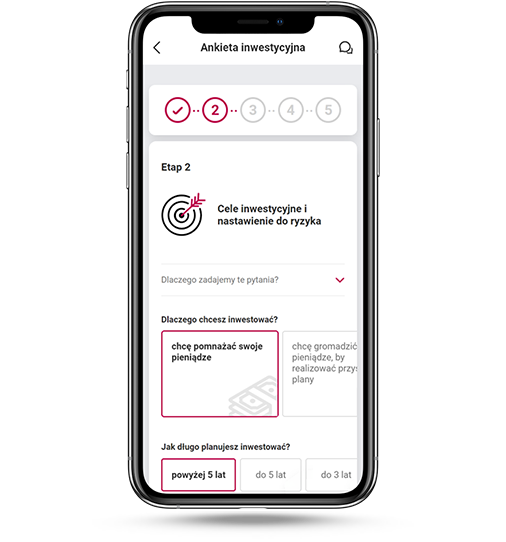

Jeśli nie masz wypełnionej i aktualnej ankiety inwestycyjnej, poprosimy Cię o jej wypełnienie, a jeśli nie masz podpisanej umowy ramowej, to również o jej zawarcie – wszystko zajmie Ci tylko kilka minut.

-

4

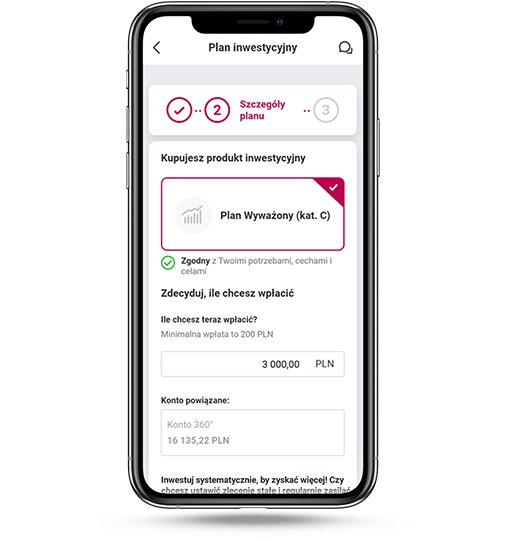

Określ szczegóły swojego planu i dokonaj pierwszej wpłaty. Aby inwestować regularnie, możesz utworzyć zlecenie stałe.

-

5

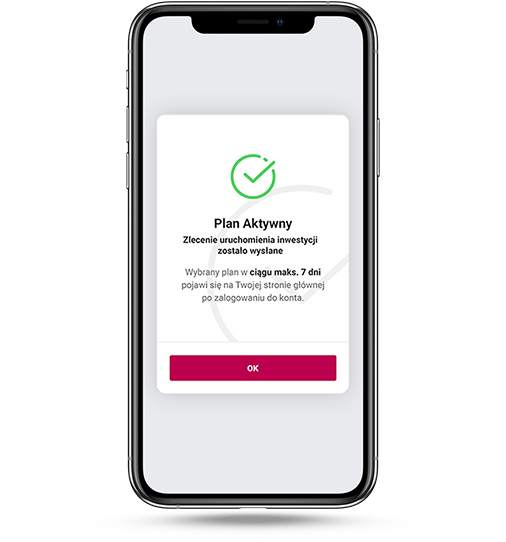

Gotowe! Utworzenie planu zostało zlecone. W ciągu 7 dni zlecenie zostanie zrealizowane, wtedy po zalogowaniu do konta zobaczysz kafel z nowym produktem.

Notowania

Szczegóły i opłaty

- Czas trwania planu

Nie musisz niczego dziś deklarować. Masz pełną elastyczność. To od Ciebie zależy kiedy będziesz chciał wypłacić środki. Zawsze masz dostęp do swoich środków, niezależnie od tego, kiedy podejmiesz decyzję o ich wypłacie.

Okres inwestycji to okres od daty realizacji zlecenia nabycia poszczególnych jednostek uczestnictwa subfunduszu w ramach planu do dnia realizacji dowolnego zlecenia odkupienia.

Co warto wiedzieć

-

Wypłata środków przed zakończeniem Planu

Zawsze masz dostęp do swoich środków. Przez pierwsze 12 miesięcy od dnia rozpoczęcia Twojej inwestycji w ramach planu, każda wypłata z planu zostanie obciążona procentową opłatą manipulacyjną.

-

Zmiana planu w trakcie inwestycji

W każdym momencie możesz zmienić posiadany plan na inny. Zamiany są całkowicie darmowe. Pamiętaj, że jeśli otworzysz nowy rejestr okres w którym naliczane są opłaty za wypłatę środków będzie liczony od nowa.

-

Zwiększenie inwestycji

Zawsze masz możliwość dokonania kolejnej wpłaty do swojego planu inwestycyjnego.

-

Zakładanie kilku planów

Możesz otworzyć wiele planów, dzieląc swoje środki na wybrane plany.

Dopiero zaczynasz inwestować?

Wypełnij ankietę MiFID

Ankieta składa się z kilku pytań. Odpowiedzi na nie pozwolą Ci poznać, jakim typem inwestora jesteś. A nam pozwolą przedstawić Ci produkty, które odpowiadają Twoim potrzebom, oczekiwaniom i doświadczeniu inwestycyjnemu, oraz są dla Ciebie adekwatne.

- link otwiera się w nowym oknie Subfundusz Plan Aktywny – Kluczowe Informacje dla Inwestorów

- link otwiera się w nowym oknie Subfundusz Plan Wyważony – Kluczowe Informacje dla Inwestorów

- link otwiera się w nowym oknie Subfundusz Plan Spokojny – Kluczowe Informacje dla Inwestorów

- link otwiera się w nowym oknie Prospekt Informacyjny Millennium FIO

- link otwiera się w nowym oknie Prospekt Informacyjny Millennium SFIO

- link otwiera się w nowym oknie Informacja AFI Millennium SFIO

Pytania i odpowiedzi

-

Co trzeba zrobić, by zacząć inwestować w Banku Millennium?

Dostęp do oferty produktów inwestycyjnych w Banku Millennium otrzymasz po wypełnieniu ankiety inwestycyjnej (Testu oceny grupy docelowej oraz adekwatności) i podpisaniu Umowy ramowej o świadczenie usług finansowych. Dzięki odpowiedziom udzielonym w ankiecie, poznajemy Twoją wiedzę i dotychczasowe doświadczenie inwestycyjne oraz jesteśmy w stanie ocenić, czy wybrany produkt inwestycyjny jest dla Ciebie adekwatny oraz zgodny z Twoimi potrzebami, cechami i celami. Jeśli chcesz uzyskać dostęp do produktów inwestycyjnych w aplikacji mobilnej oraz w Millenecie konieczne będzie również podpisanie umowy dostępu do usług przez kanały bankowości elektronicznej.

Ankietę możesz wypełnić, a umowę wygodnie podpisać w Millenecie, aplikacji mobilnej Banku Millennium lub dowolnej placówce Banku.

-

Jak działa Plan Inwestycyjny Millennium?

Jeśli masz już dostęp do oferty produktów inwestycyjnych w Banku Millennium, możesz wybrać Plan, który spełnia Twoje oczekiwania inwestycyjne co do wysokości potencjalnego zysku i poziomu ryzyka. Następnie określ kwotę, którą chcesz zainwestować, a Twoje środki zostaną zainwestowane w pakiet funduszy inwestycyjnych zgodnie z polityką wybranego przez Ciebie planu.

-

W jaki sposób można rozpocząć inwestowanie w ramach Planu Inwestycyjnego Millennium?

Plan możesz otworzyć w aplikacji mobilnej, Millenecie i w każdej placówce Banku Millennium. Minimalna wysokość pierwszej i każdej kolejnej wpłaty wynosi 200 zł.

-

W co inwestowane są moje środki w ramach Planu Inwestycyjnego Millennium?

Plan Inwestycyjny Millennium to trzy gotowe plany do wyboru (Spokojny, Wyważony i Aktywny), które różnią się wysokością potencjalnych zysków i poziomem ryzyka inwestycyjnego. Każdy z nich oferuje dywersyfikację środków, czyli jednoczesną inwestycję w wiele globalnych funduszy inwestycyjnych wyselekcjonowanych przez ekspertów Millennium TFI. Dzięki temu ograniczasz ryzyko inwestycji, rozkładając je pomiędzy różnorodne strategie inwestycyjne, a jednocześnie korzystasz z potencjału światowych rynków.

Do Ciebie należy decyzja, który plan spełnia Twoje oczekiwania inwestycyjne. Więcej informacji o strategii inwestycyjnej każdego planu inwestycyjnego znajdziesz w Karcie Funduszu oraz w KIID.

-

Czy regularne wpłaty do Planu Inwestycyjnego Millennium są konieczne?

Regularne wpłaty do Planu nie są konieczne. Kolejne wpłaty można realizować w dowolnym momencie, a minimalna wysokość każdej kolejnej wpłaty wynosi 200 zł.

Warto wiedzieć, że w dłuższym terminie regularne inwestowanie nawet niewielkich kwot daje możliwość zgromadzenia znaczącego kapitału w przyszłości. Ponadto, wpłacając środki w różnych okresach, uśrednisz cenę nabycia jednostek uczestnictwa, co może mieć wpływ na ograniczenie ryzyka zakupu wszystkich jednostek uczestnictwa po najmniej korzystnej cenie.

Ważne informacje

Ryzyka

-

Ryzyka

Transakcje finansowe wiążą się z ryzykiem przedstawionym w opisie ryzyka związanego z instrumentami i produktami finansowymi dla osób fizycznych w Banku Millennium S.A. dostępnym w placówkach i na stronie internetowej Banku www.bankmillennium.pl..

Inwestowanie w fundusze wiąże się z ryzykiem poniesienia straty, jak również z obowiązkiem uiszczenia opłat manipulacyjnych i podatku dochodowego. Fundusz nie gwarantuje osiągnięcia celu inwestycyjnego ani określonego wyniku inwestycyjnego. Wartość aktywów netto funduszy cechuje się dużą zmiennością ze względu na skład portfela inwestycyjnego. W przypadkach, w których Statut Funduszu przewiduje możliwość lokowania więcej niż 35% aktywów Subfunduszu w papiery wartościowe - emitentem, poręczycielem lub gwarantem tych papierów wartościowych może być wyłącznie Skarb Państwa, NBP, rząd USA, Europejski Bank Centralny lub Europejski Bank Inwestycyjny.

Plany Inwestycyjnego Millennium mogą być niezgodne z Twoją wiedzą, doświadczeniem, sytuacją finansową, tolerancją ryzyka lub celami inwestycyjnymi.

Na etapie wyboru produktu, mając na względzie odpowiedzi udzielone w ankiecie inwestycyjnej, każdorazowo przekazujemy informację, czy produkt jest zgodny z Twoimi cechami, celami i potrzebami. W przypadku niezgodności oraz niecałkowitej zgodności produktu z Twoimi cechami, celami i potrzebami, przekażemy stosowne ostrzeżenie, a nabycie może nastąpić wyłącznie z Twojej inicjatywy.

-

Fundusz Inwestycyjny to podmiot posiadający osobowość prawną, działający na podstawie Ustawy z dnia 27 maja 2004 r. o funduszach inwestycyjnych i zarządzaniu alternatywnymi funduszami inwestycyjnymi, którego wyłączną formą działalności jest lokowanie środków pieniężnych zebranych publicznie lub niepublicznie w papiery wartościowe, instrumenty rynku pieniężnego i inne prawa majątkowe określone w Ustawie.

W zamian za dokonane wpłaty do funduszu, inwestorzy otrzymują jednostki uczestnictwa. Ich liczba pokazuje proporcjonalny udział uczestnika w majątku funduszu inwestycyjnego. Z ustaloną w statucie funduszu częstotliwością fundusz inwestycyjny oblicza „wartość aktywów netto funduszu" przypadających na jednostkę uczestnictwa i w ten sposób ustala wartość jednostek uczestnictwa. W tym celu fundusz wycenia aktywa netto w portfelu inwestycyjnym funduszu, a następnie dzieli jego wartość przez liczbę jednostek uczestnictwa przysługujących wszystkim uczestnikom. Wartość jednostki uczestnictwa może się zmieniać w każdym dniu wyceny.

-

Z inwestycją w fundusze inwestycyjne wiążą się następujące ryzyka:

- ryzyko branży,

- ryzyko kredytowe,

- ryzyko krótkookresowych zmian cen,

- ryzyko kursu walutowego,

- ryzyko niedopuszczenia papierów wartościowych emitenta do obrotu na rynku regulowanym,

- ryzyko płynności,

- ryzyko podatkowe,

- ryzyko prawne,

- ryzyko rozliczenia,

- ryzyko rynkowe,

- ryzyko stopy procentowej,

- ryzyko utraty kapitału,

- ryzyko związane z koncentracją aktywów bądź rynków,

- wysokość opłat,

- złożoność produktu.

Przed dokonaniem inwestycji należy dokładnie zapoznać się z informacjami o funduszach, w tym danymi finansowymi i opisem czynników ryzyka, które są zawarte w prospektach informacyjnych i Kluczowych Informacjach dla Inwestorów (KIID), raportem Ex-Ante dostępnych wraz z tabelą opłat funduszy w placówkach Banku Millennium, w siedzibie Millennium TFI oraz na stronie internetowej www.millenniumtfi.pl.

-

Środki zainwestowane w Plan Inwestycyjny Millennium nie są objęte systemem gwarantowania Bankowego Funduszu Gwarancyjnego, zgodnie z ustawą o Bankowym Funduszu Gwarancyjnym, systemie gwarantowania depozytów oraz przymusowej restrukturyzacji z dnia 10 czerwca 2016 r.

-

Wszelkie informacje zawarte w niniejszej PUBLIKACJI HANDLOWEJ mają wyłącznie charakter informacyjny i nie stanowią ani oferty w rozumieniu Ustawy z dnia 23 kwietnia 1964 r. Kodeks cywilny, ani rekomendacji, ani też kierowanego do kogokolwiek (lub jakiejkolwiek grupy osób) zaproszenia do zawarcia transakcji na instrumentach finansowych w niej przedstawionych. W szczególności informacje nie są usługą doradztwa inwestycyjnego, finansowego, podatkowego, prawnego ani jakiegokolwiek innego. Jakakolwiek decyzja inwestycyjna powinna zostać podjęta na podstawie informacji zawartych w prospektach informacyjnych i Kluczowych Informacjach dla Inwestorów (KIID), a nie zawartego w niniejszej publikacji skróconego opisu.

Rozpowszechnianie i dystrybucja niektórych instrumentów lub produktów finansowych oraz obrót nimi mogą być przedmiotem ograniczeń w odniesieniu do pewnych osób i państw, zgodnie z właściwym prawodawstwem. Oferowanie instrumentów finansowych oraz obrót nimi mogą być dokonywane jedynie przy zachowaniu zgodności z właściwymi przepisami prawa.

MiFID

Dyrektywa europejska dotycząca rynku instrumentów i produktów finansowych

-

Dyrektywa europejska dotycząca rynku instrumentów i produktów finansowych

MiFID (ang. Markets in Financial Instruments Directive) to Dyrektywa Europejska dotycząca rynku instrumentów i produktów finansowych, która ustanawia jednolite ramy prawne dla banków, domów maklerskich oraz innych podmiotów prowadzących działalność maklerską na terenie Unii Europejskiej, a także Islandii, Norwegii i Lichtensteinu.

Celem Dyrektywy MiFID jest wzmocnienie i ujednolicenie ochrony klientów w poszczególnych bankach, zwiększenie spójności i przejrzystości funkcjonowania banków, a także zwiększenie konkurencyjności na rynku instrumentów finansowych.

-

Tutaj znajdziesz podstawowe informacje na temat MiFID. Dowiedz się więcej

-

Zapoznaj się z zasadami klasyfikacji Klientów oraz obowiązkami Banku. Dowiedz się więcej

-

Sprawdzimy, które instrumenty i produkty finansowe oraz usługi inwestycyjne są dla Ciebie adekwatne. Dowiedz się więcej

-

Zapoznaj się z charakterem instrumentów i produktów finansowych oraz związanymi z nimi ryzykami. Dowiedz się więcej

-

Działamy rzetelnie i w najlepiej pojętym interesie Klientów. Dowiedz się więcej

-

Tutaj znajdziesz wszystkie dokumenty na temat MiFID w Banku Millennium. Dowiedz się więcej

Skontaktuj się z nami

-

Wypełnij formularz

Masz pytania? Napisz do nas

-

lub zadzwoń - infolinia czynna całą dobę