Od 25.08 nie będzie możliwe logowanie do Millenetu z wersji przeglądarki, z której teraz korzystasz. Zaktualizuj przeglądarkę na swoim urządzeniu i korzystaj z bankowości internetowej wygodnie i bezpiecznie.

Zaktualizuj przeglądarkęDlaczego warto skorzystać

Wybierz Kredyt Hipoteczny na atrakcyjnych warunkach (RRSO 7,33%):

- 0% prowizji za udzielenie kredytu i wcześniejszą spłatę (RRSO 7,33%)

- oprocentowanie niższe nawet o 0,6 p.p w porównaniu z cennikiem, jeśli spełnisz dodatkowe warunki

- wakacje kredytowe raz w roku

- status wniosku śledzisz w aplikacji mobilnej, nawet jeśli nie masz u nas konta

- wsparcie specjalistów kredytowych na każdym etapie

Twoja nieruchomość jest energooszczędna?

EKO kredyt hipoteczny jest dla Ciebie.

EKO kredyt hipoteczny

Rata kredytu stała przez 5 lat

Rozważ kredyt ze stałą stopą procentową:

- przez 5 lat Twoja rata nie zmieni się

- po 5 latach możesz wybrać oprocentowanie stałe na kolejne 5 lat. Jeśli tego nie zrobisz, oprocentowanie kredytu będzie ponownie zmienne

- jeśli masz kredyt w złotówkach ze zmienną stopą procentową, możesz złożyć wniosek o zmianę na oprocentowanie stałe

INFORMACJA

Od 1 marca 2023 roku zawiesiliśmy oferowanie kredytów hipotecznych ze zmiennym oprocentowaniem w całym okresie kredytowania.

W naszej ofercie pozostają kredyty hipoteczne z oprocentowaniem okresowo stałym przez 5 pierwszych lat.

Kalkulator Kredytu Hipotecznego

Kalkulację wykonaliśmy na podstawie wprowadzonych przez Ciebie danych do kalkulatora. Zawiera ona orientacyjne i przykładowe wyliczenia na dzień, w którym ją wykonujemy. Służy tylko do celów informacyjnych. Nie traktuj jej jako oferty, rekomendacji, zaproszenia do zawarcia umowy kredytowej ani usługi doradztwa. Rata wyliczana jest przy założeniu, że kredyt będziesz spłacać w ratach równych. Możesz również wnioskować o kredyt w ratach malejących. Ostateczna wysokość raty będzie zależała od pełnej oceny Twojej zdolności kredytowej. Aby otrzymać kredyt hipoteczny, musisz również spełnić inne, niezbędne warunki.

Oprocentowanie okresowo stałe to oprocentowanie stałe przez 60 miesięcy od wypłaty kredytu. Po tym okresie oprocentowanie kredytu będzie zmienne i będzie się składało z marży i wskaźnika referencyjnego WIBOR 6M. Możemy też uzgodnić nowe oprocentowanie okresowo stałe na kolejne 60 miesięcy i podpisać aneks do umowy kredytu. W okresie stosowania stałego oprocentowania nie możesz go zmienić na zmienne.

Rzeczywista Roczna Stopa Oprocentowania (RRSO) dla kredytu hipotecznego o wybranych parametrach wynosi {rrso}. Wyliczyliśmy ją przy założeniu, że po 60 miesiącach obowiązywania oprocentowania okresowo stałego, stopa oprocentowania kredytu jest taka sama jak w chwili wyliczania RRSO w oparciu o obowiązującą w tym czasie wartość uzgodnionego wskaźnika referencyjnego, ale nie niższa niż stała stopa procentowa.

Rzeczywista Roczna Stopa Oprocentowania (RRSO) przy założeniu, że po zakończeniu pierwszego 60-miesięcznego okresu obowiązywania oprocentowania okresowo stałego spłacisz cały kredyt wynosi {rrso5years}. Jeśli w kalkulatorze kredytu hipotecznego została zaznaczona oferta z obniżką oprocentowania za korzystanie z dodatkowych produktów lub usług finansowych, założyliśmy, że spełnisz warunki utrzymania tej obniżki. Nie musisz wybierać dodatkowych produktów lub usług finansowych, możesz wybrać sam kredyt. Skorzystanie z dodatkowych produktów i usług nie jest warunkiem uzyskania kredytu, ale ma wpływ na jego warunki cenowe. Zanim udzielimy Ci kredytu ocenimy Twoją zdolność i wiarygodność kredytową. W uzasadnionym przypadku możemy nie udzielić Ci kredytu.

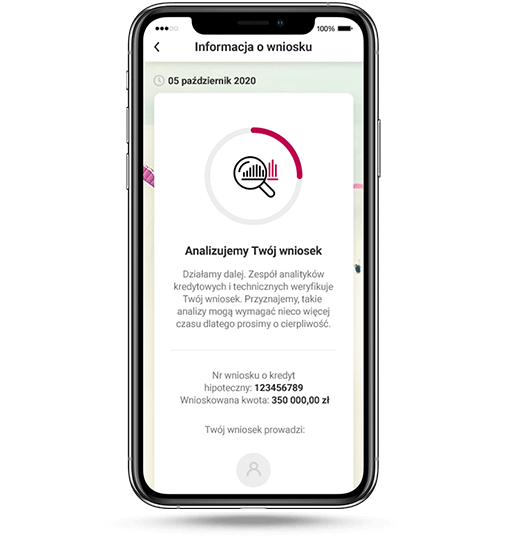

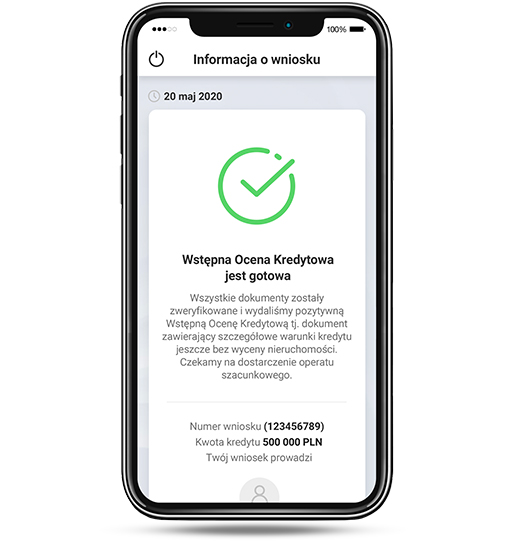

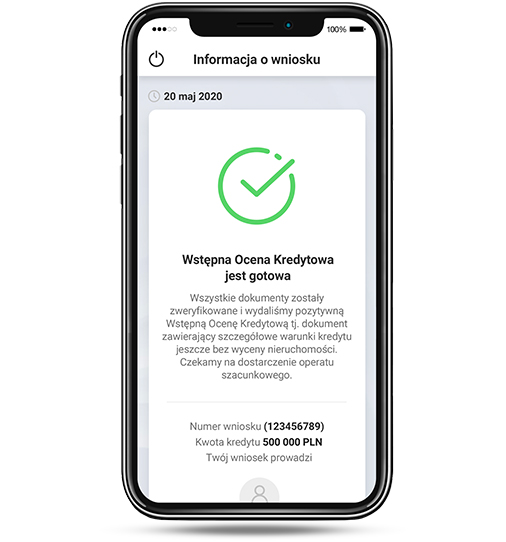

Status wniosku sprawdzisz przez internet

Na bieżąco możesz śledzić status swojego wniosku o kredyt hipoteczny w Millenecie i aplikacji mobilnej:

-

Widzisz, na jakim etapie jest wniosek i co się z nim dzieje

-

Dostajesz powiadomienia o zmianie statusu wniosku

-

Znasz kolejne kroki działania

-

1

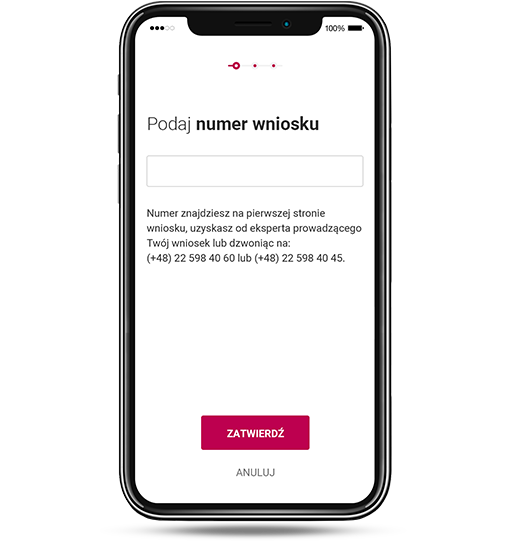

Pobierz aplikację mobilną i na dole ekranu wybierz opcję Status wniosku hipotecznego

-

2

Podaj wymagane dane, np. numer wniosku kredytowego, dane z identyfikatora (np. numeru PESEL)

-

3

Gotowe! Teraz widzisz na bieżąco, co dzieje się z Twoim wnioskiem

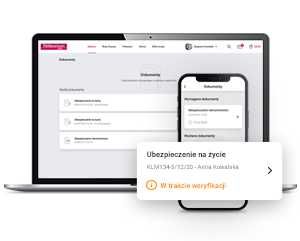

Wygodnie załączysz

dokumenty ubezpieczeniowe

Jeśli wybierzesz ubezpieczenie nieruchomości lub ubezpieczenie na życie wymagane do zabezpieczenia kredytu w innej instytucji, wszystkie dokumenty łatwo i szybko załączysz przez internet:

- dokumenty ubezpieczenia nieruchomości i na życie dodasz w aplikacji i Millenecie

- przypomnimy Ci o zbliżającym się terminie

- poinformujemy Cię o rezultacie weryfikacji dokumentów

- jeśli zajdzie potrzeba ponownego dodania dokumentów, zrobisz to również po upłynięciu terminu ważności polisy wygodnie przez Millenet i aplikację mobilną

Fundusz Wsparcia Kredytobiorców

Fundusz powstał, aby wspomóc osoby, które znalazły się w trudnej sytuacji finansowej i spłacają raty kredytu mieszkaniowego.

Pytania i odpowiedzi

-

Na co mogę przeznaczyć kredyt hipoteczny?

Kredytem hipotecznym sfinansujesz zakup domu lub mieszkania na rynku pierwotnym lub wtórnym, budowę lub rozbudowę domu, remont lub modernizację. Możesz także refinansować kredyt mieszkaniowy z innego banku.

-

Co to jest zdolność kredytowa i jak ją wyliczyć?

Zdolność kredytowa określa Twoje możliwości do spłaty zaciągniętego kredytu wraz z odsetkami w terminie. Swoją orientacyjną zdolność kredytową możesz obliczyć za pomocą kalkulatora kredytu hipotecznego. Dzięki kalkulatorowi sprawdzisz także orientacyjnie, jakiej raty kredytu możesz się spodziewać.

Twoją zdolność kredytową wyliczy Bank na podstawie wniosku kredytowego.

-

Czy należy mi się zwrot prowizji za podwyższone ryzyko do czasu ustanowienia hipoteki?

Tak, jeśli umowa kredytu hipotecznego została zawarta (podpisana) do 16 września 2022 roku, a sąd wpisze hipotekę 17 września 2022 roku lub w terminie późniejszym, zwrócimy Ci całość pobranej prowizji.

Kiedy dostanę zwrot prowizji?

Gdy sąd wpisze hipotekę do księgi wieczystej, a my zweryfikujemy i potwierdzimy, że wpis spełnia warunki określone w umowie kredytu, to zwrócimy prowizję. Prowizję zwracamy w ciągu 60 dni od wpisu hipoteki.W jaki sposób otrzymam zwrot prowizji?

Prowizję zwracamy na konto, z którego ją pobieraliśmy.Czy muszę składać wniosek o zwrot prowizji?

Nie musisz składać żadnego wniosku.Podstawa prawna zwrotu prowizji

"Ustawa z dnia 5 sierpnia 2022 roku o zmianie ustawy o kredycie hipotecznym oraz o nadzorze nad pośrednikami kredytu hipotecznego i agentami oraz ustawa o zmianie ustawy o podatku dochodowym od osób fizycznych, ustawa o podatku dochodowym od osób prawnych oraz niektórych innych ustaw”. -

Czy mogę wcześniej spłacić kredyt hipoteczny?

Tak. Możesz dokonać wcześniejszej częściowej i całkowitej spłaty kredytu bez dodatkowych kosztów. Spłatę częściową wygodnie zlecisz w Millenecie, natomiast spłatę całkowitą możesz zlecić w placówce.

- Ukryj Pokaż więcej

Informacje dodatkowe

Lista wymaganych dokumentów

-

- Wniosek o udzielenie informacji o kredycie

- Dokumenty potwierdzające tożsamość (dowód osobisty lub paszport)

-

1. Operat szacunkowy nieruchomości

Do podjęcia decyzji kredytowej będziemy potrzebowali wyceny mieszkania/domu przez rzeczoznawcę majątkowego.

Jeśli nie masz operatu, możesz skorzystać ze wsparcia Banku w pozyskaniu operatu szacunkowego. Wystarczy, że:

- zamówisz operat szacunkowy podczas składania wniosku o kredyt (lub na późniejszym jego etapie) i wybierzesz jednego z dwóch współpracujących z Bankiem dostawców o ogólnopolskim zasięgu

- opłacisz operat przelewem bezpośrednio na rachunek dostawcy (Bank nie pobiera żadnych opłat za pomoc w zleceniu operatu)

- w ciągu zaledwie kilku minut Twoje zlecenie i wymagane dokumenty trafią do rzeczoznawcy

- w trosce o Twoje bezpieczeństwo rzeczoznawca może przeprowadzić oględziny on-line, bez fizycznej wizyty w mieszkaniu/domu

- operat otrzymasz nawet w ciągu 3-4 dni (od chwili oględzin) w wersji elektronicznej i/lub papierowej

- operat równolegle zostanie udostępniony Bankowi, co skróci czas do wydania decyzji kredytowej

Aktualny cennik współpracujących z Bankiem dostawców:

- 499 zł lokal mieszkalny, garaż, grunt niezabudowany

- 799 zł budynek mieszkalny jednorodzinny, segment, bliźniak, lokal mieszkalny w budynku w zabudowie szeregowej lub bliźniaczej

Możesz także dostarczyć nam swój operat szacunkowy wykonany przez uprawnionego rzeczoznawcę majątkowego. Sprawdź Centralny Rejestr Rzeczoznawców Majątkowychlink otwiera się w nowej karcie.

2. Odpis z księgi wieczystej – dotyczy nieruchomości proponowanej na zabezpieczenie kredytu

Dodatkowo, gdy zabezpieczeniem będzie: dom jednorodzinny lub niezabudowana działka budowlana mogą być wymagane:

- ostateczne pozwolenie na użytkowanie, lub gdy nie jest ono wymagane prawem, zawiadomienie o zakończeniu budowy wraz z informacją o braku wniesienia sprzeciwu potwierdzone przez właściwy organ, lub decyzja o wysokości podatku od nieruchomości

- wyrys z rejestru gruntów lub kopia mapy ewidencyjnej

- zaświadczenie lub wypis z planu zagospodarowania przestrzennego potwierdzające przeznaczenie nieruchomości

-

- Zaświadczenie o zatrudnieniu i wysokości dochodów Pobierzplik PDF otwiera się w nowej karcie

- Zaświadczenie o zatrudnieniu i wysokości dochodu (wersja angielska) Pobierzplik PDF otwiera się w nowej karcie

- Wyciągi z rachunku bieżącego za okres ostatnich 3 miesięcy

Jak możesz

obniżyć oprocentowanie

-

Możesz obniżyć oprocentowanie kredytu hipotecznego nawet o 0,6 punktu procentowego (p.p), jeśli łącznie spełnisz wszystkie opisane poniżej warunki:

- masz lub założysz konto osobiste w naszym banku

- na Twoje konto osobiste w Millennium co miesiąc będzie wpływać Twoje wynagrodzenie lub inny dochód netto

- w każdym miesiącu wydasz 500 zł płacąc kartą debetową do tego konta

- skorzystasz z ubezpieczenia Życie pod ochroną za naszym pośrednictwem

Życie pod ochroną to dobrowolne ubezpieczenie indywidualne, w których ochronę ubezpieczeniową zapewnia Towarzystwo Ubezpieczeń na Życie Europa S.A. Bank Millennium jest agentem ubezpieczeniowym, który działa w imieniu TU na Życie Europa S.A. i za jego pośrednictwem można zawrzeć umowę o to ubezpieczenie. Szczegółowe informacje są opisane w Ogólnych Warunkach Ubezpieczenia oraz Karcie Produktu, które znajdziesz tutajplik PDF otwiera się w nowej karcie.

Utrzymasz obniżkę nawet o 0,6 p.p. do końca okresu kredytowania, jeśli łącznie spełnisz wszystkie opisane poniżej warunki:

- w każdym z kolejnych 55 miesięcy po miesiącu, w którym wypłacimy kredyt, na Twoje konto osobiste w naszym banku będzie trafiać Twoje wynagrodzenie lub inny dochód netto

- w każdym z kolejnych 55 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt wydasz 500 płacąc kartą debetową do tego konta

- będziesz utrzymywać ubezpieczenie Życie pod ochroną przez 36 kolejnych miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt

Jeśli kredyt został udzielony więcej niż jednemu kredytobiorcy, z ubezpieczenia Życie pod ochroną przez 36 miesięcy muszą korzystać wszyscy, którzy są zobowiązani do ustanowienia zabezpieczenia spłaty kredytu w postaci cesji praw z umowy Ubezpieczenia Życie pod ochroną.

Utrzymasz prawo do obniżki, nawet jeśli nie spełnisz warunków płatności kartą debetową i wpływu wynagrodzenia na konto w 5 dowolnych miesiącach kalendarzowych.

-

Możesz obniżyć oprocentowanie nawet o 0,4 punktu procentowego (p.p), jeśli łącznie spełnisz wszystkie opisane poniżej warunki:

- masz lub założysz konto osobiste w naszym banku

- na Twoje konto osobiste w Millennium co miesiąc będzie wpływać Twoje wynagrodzenie lub inny dochód netto

- w każdym miesiącu wydasz 500 zł płacąc kartą debetową do tego konta

Utrzymasz obniżkę nawet o 0,4 p.p. do końca okresu kredytowania, jeśli łącznie spełnisz wszystkie opisane poniżej warunki:

- w każdym z kolejnych 55 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt, na Twoje konto osobiste w naszym banku będzie trafiać Twoje wynagrodzenie lub inny dochód netto

- przez kolejnych 55 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt wydasz 500 zł płacąc kartą debetową do tego konta

Utrzymasz prawo do obniżki, nawet jeśli nie spełnisz warunków płatności kartą debetową i wpływu wynagrodzenia na konto w 5 dowolnych miesiącach kalendarzowych.

-

Możesz obniżyć oprocentowanie o 0,2 punktu procentowego (p.p), i utrzymać obniżkę do końca okresu kredytowania, jeśli w każdym z kolejnych 55 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt łącznie spełnisz wszystkie opisane poniżej warunki:

- masz lub założysz konto osobiste w naszym banku

- w każdym miesiącu wydasz 500 zł płacąc kartą debetową do tego konta

Utrzymasz prawo do obniżki, nawet jeśli nie spełnisz warunków płatności kartą debetową i wpływu wynagrodzenia na konto w 5 dowolnych miesiącach kalendarzowych.

Stałe lub zmienne oprocentowanie

-

Jeśli cenisz sobie spokój i chcesz mieć pewność, że rata Twojego kredytu hipotecznego nie zmieni się przez najbliższe 5 lat rozważ kredyt ze stopą stałą. Stała stopa procentowa dostępna jest dla kredytów hipotecznych w PLN.

- Wybierając kredyt hipoteczny ze stałym oprocentowaniem masz 30 dni do zaakceptowania decyzji kredytowej i podpisania umowy.

- W trakcie trwania pierwszego, 5-letniego okresu obowiązywania stałej stopy (przez 60 m-cy, począwszy od dnia uruchomienia kredytu) nie możesz przejść na oprocentowanie zmienne.

- Po zakończeniu tego okresu możesz zdecydować się na kolejny, nowo ustalony 5-letni okres stałego oprocentowania lub przejść na oprocentowanie zmienne, stanowiące sumę marży banku i stopy referencyjnej WIBOR 6M.

- Jeśli zdecydujesz się na kolejny okres, przekażemy Ci propozycję oprocentowania stałego na kolejne 5 lat.

- Jeśli nie zaakceptujesz nowej wysokości stałego oprocentowania, po tym okresie Twój kredyt będzie oprocentowany wg. zmiennej stopy procentowej a wysokość Twoich rat uzależniona będzie od wysokości WIBOR-u oraz marży określonej w umowie kredytowej.

- Jeśli zaakceptujesz warunki i podpiszesz aneks do umowy kredytu, będziesz mógł korzystać ze stałej stopy na nowych warunkach przez kolejne 5 lat.

- Jeżeli masz już kredyt w PLN z oprocentowaniem zmiennym, możesz złożyć wniosek o zmianę oprocentowania na stałe, obowiązujące przez 5 lat.

W przypadku stosowania oprocentowania okresowo stałego, obowiązuje ono przez okres 5 lat. W tym okresie wysokość raty kapitałowo-odsetkowej Twojego kredytu nie zmieni się, ponieważ nie jest zależna od zmiany wskaźnika referencyjnego. Natomiast występuje ryzyko, że w okresie stosowania stałej stopy procentowej wysokość Twojej raty może być okresowo wyższa, niż gdyby była ona obliczana na podstawie aktualnej stopy referencyjnej WIBOR 6M, wykorzystywanej jako wskaźnik referencyjny w kalkulacji wysokości oprocentowania zmiennego. Po upływie ww. 5-letniego okresu, możesz wybrać zastosowanie oprocentowania okresowo stałego (uwaga: może się różnić od oprocentowania w poprzednim okresie) na kolejny 5-letni okres (analogicznie jest w przypadku następnych okresów) lub też zastosowanie oprocentowania zmiennego.

Z kolei w okresie stosowania zmiennej stopy procentowej występuje ryzyko zmian stóp procentowych. Ryzyko zmiany stóp procentowych oznacza, że w przypadku wzrostu poziomu stopy referencyjnej WIBOR 6M wyższe będzie oprocentowanie kredytu, wzrośnie wówczas wysokość miesięcznej raty kapitałowo-odsetkowej, a to natomiast powoduje wzrost kosztu odsetek i tym samym wzrost całkowitego kosztu kredytu hipotecznego.

-

Co musisz zrobić, żeby uzgodnić nową stałą stopę procentową na kolejny okres?

Jeśli masz kredyt z oprocentowaniem okresowo stałym i chcesz uzgodnić z nami nową stałą stopę procentową na kolejne 60 miesięcy, złóż wniosek nie później niż na 30 dni przed upływem aktualnego okresu obowiązywania stałej stopy procentowej. Wniosek możesz złożyć w każdej naszej placówce.

Uzgodnienie nowej stałej stopy procentowej na kolejny okres wymaga zawarcia aneksu do umowy.

Kiedy możesz złożyć wniosek?

Przypomnimy Ci, do kiedy możesz złożyć wniosek o ustalenie nowej stałą stopę procentową, zanim skończy się okres obowiązywania obecnej stałej stopy procentowej. Wyślemy Ci SMS i pismo.

Jak ustalimy wysokość nowego oprocentowania stałego?

Wysokość nowej stałej stopy procentowej na kolejne 60 miesięcy ustalamy zgodnie z cennikiem obowiązującym w dniu złożenia przez Ciebie wniosku. Aktualny cenniklink otwiera się w nowym oknie dostępny jest na naszej stronie internetowej.

Abyśmy mogli wprowadzić do umowy nową wysokość stałego oprocentowania na kolejne 60 miesięcy, musimy podpisać z Tobą aneks do umowy. Zawarcie aneksu jest bezpłatne.

Co w sytuacji, gdy nie uzgodnimy nowej stałej stopy procentowej

Jeśli nie złożysz wniosku lub nie uzgodnimy nowej stałej stopy procentowej na kolejne 60 miesięcy, Twój kredyt w dalszym okresie kredytowania będzie oprocentowany według zmiennej stopy procentowej, która jest sumą marży banku i wskaźnika referencyjnego wskazanych w Twojej umowie kredytowej.

-

Możesz zmienić sposób oprocentowania swojego kredytu lub pożyczki hipotecznej na okresowo stałe przez 5 lat. Po tym czasie Twój kredyt automatycznie powróci na oprocentowanie zmienne, oparte na wskaźniku WIBOR. Możesz też ponownie złożyć wniosek o zmianę na oprocentowanie okresowo stałe na nowych warunkach, na kolejne 5 lat.

Jak to zrobić?

- Wniosek o zmianę sposobu oprocentowania swojego kredytu lub pożyczki hipotecznej składasz w dowolnej placówce banku.

- Poinformujemy Cię, jeśli będziemy potrzebowali dodatkowych dokumentów.

- Podpisujesz aneks do umowy. Koszt aneksu to 200 zł.

- Pamiętaj, że wniosek i aneks muszą podpisać wszyscy kredytobiorcy.

Możesz zmienić sposób oprocentowania, jeżeli:

- Twój kredyt jest w PLN,

- masz zdolność kredytową i płacisz raty w terminie,

- zostało Ci nie mniej niż 5 lat do końca okresu spłaty kredytu (od dnia podpisania aneksu o zmianę oprocentowania).

-

Od 1 marca 2023 roku zawiesiliśmy oferowanie kredytów hipotecznych ze zmiennym oprocentowaniem w całym okresie kredytowania.

W naszej ofercie pozostają kredyty hipoteczne z oprocentowaniem okresowo stałym przez 5 pierwszych lat.

O ubezpieczeniu na życie

-

Ubezpieczenie obejmuje Twoje życie oraz zdrowie. Ubezpieczyciel świadczy ochronę w zakresie następujących zdarzeń:

- śmierć

- całkowita niezdolność do pracy i samodzielnej egzystencji

- zdarzenie medyczne uprawniające do drugiej opinii medycznej

Życie pod ochroną to dobrowolne ubezpieczenie indywidualne, w których ochronę ubezpieczeniową zapewnia Towarzystwo Ubezpieczeń na Życie Europa S.A. Bank Millennium jest agentem ubezpieczeniowym, który działa w imieniu TU na Życie Europa S.A. i za jego pośrednictwem można zawrzeć umowę o to ubezpieczenie. Szczegółowe informacje są opisane w Ogólnych Warunkach Ubezpieczenia oraz Karcie Produktu, które znajdziesz tutajplik PDF otwiera się w nowej karcie.

Zabezpieczenia

-

Zabezpieczeniem kredytu hipotecznego są:

- hipoteka na nieruchomości mieszkalnej wpisana na pierwszym miejscu na rzecz Banku Millennium

- cesja praw z polisy ubezpieczenia nieruchomości od ognia i innych zdarzeń losowych

- cesja praw z polisy ubezpieczenia na życie kredytobiorcy wraz ze wskazaniem Banku jako jedynego do otrzymania świadczenia ubezpieczeniowego

Docelowym zabezpieczeniem kredytu może być też hipoteka na innej nieruchomości niż kredytowana. Może ona należeć do Ciebie lub osoby trzeciej.

Koszt kredytu

i nota prawna

-

RRSO dla oprocentowania okresowo stałego

Rzeczywista Roczna Stopa Oprocentowania (RRSO) dla kredytu hipotecznego z oprocentowaniem okresowo stałym wynosi 7,33% i wyliczyliśmy ją przy założeniach: całkowita kwota kredytu hipotecznego (bez kredytowanych kosztów) wynosi 549 738 zł, okres kredytowania 27 lat, rata kredytu 3 505,47 zł, liczba rat 325, oprocentowanie w pierwszym 60-miesięcznym okresie obowiązywania stopy stałej 6,23%, a w dalszym okresie kredytowania oprocentowanie zmienne 6,68% (suma stałej marży 2,10% oraz wskaźnika referencyjnego WIBOR 6M, który według stanu na 30.09.2025 r. wynosi 4,58%), kredyt zabezpieczony jest hipoteką na nowo nabywanej nieruchomości o wartości 876 775 zł. Marża wynosi 2,10%, przy założeniu, że przez 55 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt masz konto Millennium 360°, na to konto co miesiąc wpływa Twoje wynagrodzenie lub inny dochód netto i wykonasz kartą debetową do tego konta transakcje bezgotówkowe na kwotę min. 500 zł m-cznie oraz przez 36 miesięcy kalendarzowych po miesiącu, w którym wypłacimy kredyt, pozostaniesz stroną umowy ubezpieczenia na życie pod nazwą „Życie pod ochroną”, zawartej za naszym pośrednictwem (działamy jako agent ubezpieczeniowy Towarzystwa Ubezpieczeń na Życie Europa S.A.). Całkowity koszt kredytu hipotecznego wynosi 688 778,54 zł. W tej kwocie zawiera się: prowizja za udzielenie kredytu 0 zł, odsetki 625 788,38 zł, ubezpieczenie nieruchomości od ognia i innych zdarzeń losowych 21 450 zł (dostępne za naszym pośrednictwem), ubezpieczenie na życie 41 321,16 zł (dostępne za naszym pośrednictwem), PCC 19 zł i opłata sądowa za ustanowienie hipoteki 200 zł. Koszt prowadzenia konta wynosi 0 zł. Opłata za obsługę karty debetowej lub płatności zbliżeniowych BLIK wynosi 0 zł, jeśli w poprzednim miesiącu zapłacisz kartą lub BLIKIEM minimum raz, jeśli masz 18-26 lat lub 5 razy, jeśli masz powyżej 26 lat. Całkowita kwota do zapłaty wynosi 1 238 516,54 zł. Obliczenia wykonaliśmy 30.10.2025 r. na reprezentatywnym przykładzie, zakładając, że spełnisz warunki do utrzymania obniżonego oprocentowania.

W przypadku kredytu hipotecznego z okresowo stałym oprocentowaniem występuje ryzyko, że w okresie stosowania stałej stopy procentowej Twoja rata może być wyższa, niż gdyby była ona obliczana na podstawie aktualnego wskaźnika referencyjnego WIBOR 6M, który jest stosowany w kalkulacji wysokości oprocentowania zmiennego. Po zmianie oprocentowania Twojego kredytu na zmienne, wzrost wskaźnika referencyjnego w okresie obowiązywania stałej stopy procentowej może spowodować, że istotnie wzrośnie rata kapitałowo-odsetkowa i tym samym całkowity koszt Twojego kredytu. Z kolei w okresie stosowania zmiennego oprocentowania występuje ryzyko wzrostu oprocentowania. Jego wysokość zależy bowiem od wskaźnika referencyjnego WIBOR 6M. Jeśli wskaźnik referencyjny wzrośnie, to wyższe będzie oprocentowanie Twojego kredytu i wzrośnie miesięczna rata kapitałowo-odsetkowa. Wzrośnie wtedy również całkowity kosztu kredytu.

-

Szczegółowe zasady i warunki, na jakich udzielamy kredytów hipotecznych opisujemy w Regulaminie kredytowania osób fizycznych w ramach usług bankowości hipotecznej w Banku Millennium S.A. Opłaty i prowizje, które pobieramy, a także wysokość oprocentowania wskazujemy w Cenniku Kredytu Hipotecznego / Pożyczki Hipotecznej. Z tymi dokumentami możesz zapoznać się w naszych placówkach i na stronie www.bankmillennium.pl. Zanim udzielimy Ci kredytu, za każdym razem oceniamy Twoją zdolność i wiarygodność kredytową. W uzasadnionych przypadkach możemy nie udzielić Ci kredytu. Jako zabezpieczenie kredytu możesz przedstawić ubezpieczenie nieruchomości lub ubezpieczenie na życie spoza oferty dostępnej za naszym pośrednictwem. Taką umowę ubezpieczenia powinieneś zawrzeć z ubezpieczycielem, który jest na liście publikowanej przez KNF.

Możesz skorzystać z oferty dodatkowej, która polega na obniżeniu oprocentowania, jeśli wszyscy kredytobiorcy zobowiązani do ustanowienia zabezpieczenia kredytu w postaci cesji praw z umowy ubezpieczenia na życie zawrą umowę ubezpieczenia „Życie pod ochroną” za naszym pośrednictwem. Przy oferowaniu tego ubezpieczenia działamy jako agent ubezpieczeniowy Towarzystwa Ubezpieczeń na Życie Europa S.A. Skorzystanie z ubezpieczenia „Życie pod ochroną” nie jest konieczne, aby otrzymać kredyt hipoteczny, ale ma wpływ na jego warunki cenowe. Warunki, które musisz spełnić, aby utrzymać obniżkę przez cały okres kredytowania znajdziesz w dokumencie Ogólne informacje dotyczące umowy o kredyt hipoteczny. Szczegółowe zasady udzielania ochrony ubezpieczeniowej, w tym informacje o wyłączeniach odpowiedzialności ubezpieczyciela opisane są w Ogólnych Warunkach Ubezpieczenia. Podsumowanie najważniejszych cech tego ubezpieczenia znajdziesz w Karcie Produktu – Ubezpieczenie „Życie pod ochroną”. Dokumenty te dostępne są w naszych placówkach oraz na stronie www.bankmillennium.pl.

Bank Millennium S.A. z siedzibą w Warszawie ul. Stanisława Żaryna 2A działa jako Agent ubezpieczeniowy i jest wpisany do Rejestru Agentów Ubezpieczeniowych pod numerem RA 11162860/A (https://rpu.knf.gov.pl/). Wykonujemy czynności agencyjne na rzecz kilku ubezpieczycieli.

Formularz kontaktowy

Jeśli zainteresowała Cię nasza oferta i chcesz otrzymać szczegółowe informacje, wypełnij poniższy formularz - oddzwonimy!

Masz już kredyt hipoteczny w Banku Millennium?

Sprawdź nasz przewodnik po kredycie hipotecznymlink otwiera się w nowym oknie i dowiedz się więcej.

Skontaktuj się z nami

Chcesz porozmawiać teraz?

Zadzwoń

+48 22 598 40 60

od poniedziałku do piątku w godz. 8:00 - 20:00